2024 and 2025 natural gas predictions on pricing

What are the 2024 and 2025 natural gas predictions on pricing?

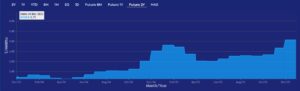

The natural gas price predictions for 2024 and 2025 vary among different sources. The World Bank forecasted that US natural gas prices could average $6 in 2024. On the other hand, the U.S. Energy Information Administration (EIA) forecasted lower wholesale U.S. natural gas prices in 2024 with prices expected to increase in the first quarter of 2024 and then drop below 2023 prices.

The predictions for the price increase are based on various factors, including changes in natural gas production, domestic consumption, LNG exports, and geopolitical pressures. Additionally, the demand for natural gas as a cleaner fossil fuel and for energy generation is expected to contribute to the price increase. It's important to note that natural gas price predictions are subject to change based on market conditions, geopolitical events and other factors. The actual prices may differ from the forecasts.

The natural gas price predictions for 2024 and 2025 vary among different sources. The World Bank forecasted that US natural gas prices could average $6 in 2024. On the other hand, the U.S. Energy Information Administration (EIA) forecasted lower wholesale U.S. natural gas prices in 2024, with prices expected to increase in the first quarter of 2024 and then drop below 2023 prices.

. ANZ Research also forecasted the LNG spot price to drop to an average of $32/MMBtu in 2023 and $23.5/MMBtu in 2024

. The predictions for the price increase are based on various factors, including changes in natural gas production, domestic consumption, LNG exports, and geopolitical pressures. Additionally, the demand for natural gas as a cleaner fossil fuel and for energy generation is expected to contribute to the price increase.

Natural gas pricing is influenced by various factors, including:

Supply and Demand: Natural gas prices are mainly a function of market supply and demand. Increases in supply generally result in lower prices, while increases in demand lead to higher prices

Weather Conditions: Seasonal weather, including tropical storms, hurricanes, blizzards, and tornadoes, can impact natural gas production and delivery, affecting pricing due to artificial scarcity caused by delayed deliveries

Storage Inventory Levels: The amount of natural gas in storage can affect prices. Low storage levels and difficulty in procuring new gas deposits can lead to forecasts of reduced supply and price increases

Imports and Exports: Volumes of natural gas imports and exports can impact pricing, with higher imports tending to pull prices down, while higher exports can push prices up

Economic Conditions and Other Fuels: Economic growth, availability, and prices of other fuels such as coal and petroleum can influence natural gas demand and pricing. When the costs of competing fuels fall, demand for natural gas may decrease, leading to lower prices

Regulatory Policies and Market Structures: Regulatory policies and market structures can also influence natural gas prices, especially in deregulated, competitive markets

Natural gas pricing is affected by a complex interplay of supply and demand dynamics, weather conditions, storage inventory levels, imports and exports, economic factors, and regulatory policies, all of which contribute to the overall cost of natural gas.

Learn More On The Future 2024 and 2025 predictions on Energy - Click Here

Compare Commercial Natural Gas Suppliers - Click Here