2026 Best Season For Pricing

Best Time to Price a Commercial Energy Contract in 2026 (By Season)

If you’re buying commercial electricity or natural gas in a deregulated market, the biggest mistake is waiting until the market is already stressed. In most years, energy prices get the most volatile during peak demand seasons summer for electricity (air-conditioning load) and winter for natural gas (heating demand + storage withdrawals)

That’s why many businesses see better outcomes when they plan pricing decisions around the shoulder seasons (spring and fall), when demand is typically more balanced and suppliers compete harder for load before the next peak cycle.

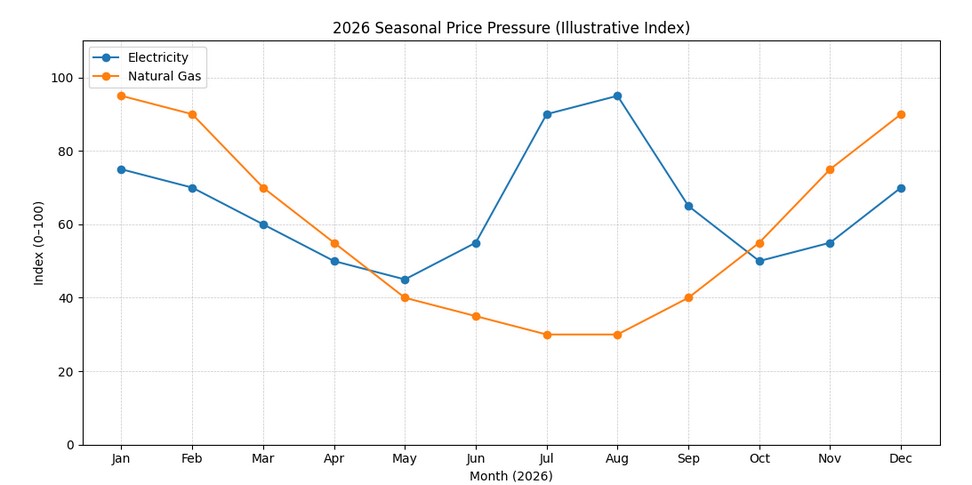

Below is a 2026 seasonal view you can use as a simple playbook plus a chart that shows when pricing pressure is usually highest vs. lowest.

2026 Seasonal Energy “Price Pressure” Chart

The 2026 Season-by-Season Pricing Strategy

Winter 2026 (Jan–Mar): Highest risk for natural gas, elevated risk for power

Winter is usually when natural gas markets are most sensitive because storage withdrawals and cold snaps can move prices fast. If you’re buying gas for heating-heavy facilities, waiting deep into winter can mean paying for volatility.

Best move: If you need winter coverage, price it before severe weather risk ramps (often earlier in the cycle), or use a layered strategy (partial lock + staged pricing).

Spring 2026 (Apr–May): One of the best windows to price

Spring is often a calmer period for both commodities because heating load fades and peak cooling hasn’t hit yet. Many businesses use spring to lock portions of summer and winter needs while volatility is typically lower.

Best move: Price or “layer in” terms (12–36 months) while the market is quieter and supplier competition is strong.

Summer 2026 (Jun–Aug): Highest risk for electricity

U.S. electricity demand commonly peaks in July or August as cooling load ramps up. That’s when power markets can spike especially during heat waves so this is usually the worst time to start shopping from scratch.

Best move: Try to have summer exposure addressed before sustained heat risk arrives.

Fall 2026 (Sep–Nov): The “smart shopper” window

Fall is often another strong shoulder-season opportunity. You’re ahead of winter heating demand, and many suppliers push competitive offers to secure load before year-end and winter volatility.

Best move: Use early fall to price winter coverage, and compare multiple suppliers while the market is still relatively stable.

What to Watch in 2026 Before You Lock In

-

Weather-driven demand risk: electricity peaks during summer cooling; gas risk rises during winter heating.

-

Natural gas storage vs 5-year average: storage can be a major sentiment driver for winter pricing.

-

Volatility events: heat waves, cold snaps, outages, pipeline constraints, and regional capacity constraints can all move pricing quickly.

Get 2026 Prices from Competing Suppliers

If you want to know whether spring or fall 2026 is the better time for your business to lock in electricity or natural gas, we can run a side-by-side supplier comparison based on your usage and location.

CTA: Compare Commercial Energy Suppliers

CTA subtext: Upload a recent utility bill and we’ll bring competing supplier offers to you.

“FAQ” block

Q: Is spring always the cheapest time to buy?

Not always market fundamentals matter but spring is often a lower-volatility window because it sits between peak winter heating and peak summer cooling.

Q: Why does natural gas matter for electricity pricing?

In many U.S. regions, natural gas is a key marginal fuel for power generation, so gas moves can influence power pricing especially during demand peaks.