2026 Great Time To Buy

2026 is the year to buy strategically because commodity markets look manageable, but reliability/capacity risk is rising. Businesses that shop early and choose the right contract structure can lock budget certainty and avoid the worst surprises.”

-

Natural gas fundamentals point to a stable-to-firmer baseline (not a spike-crash market)

-

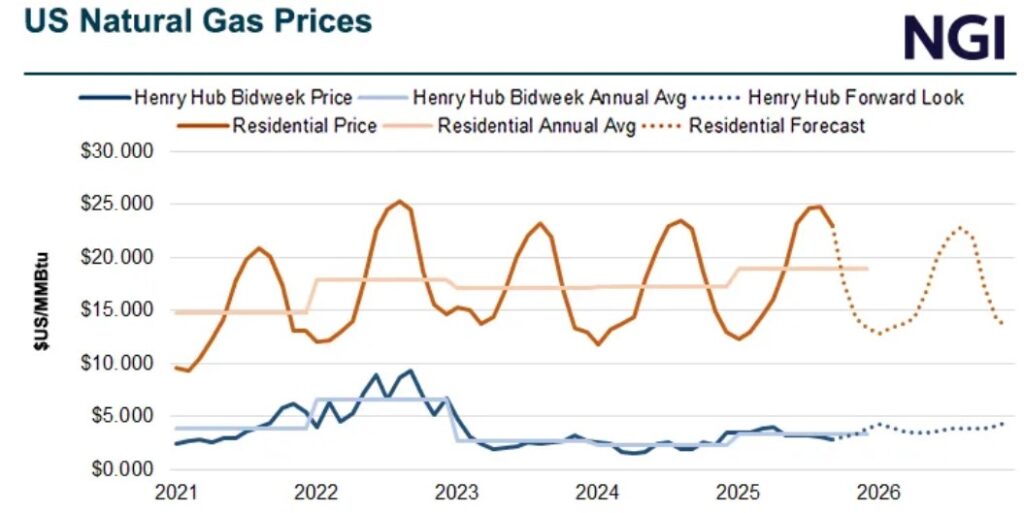

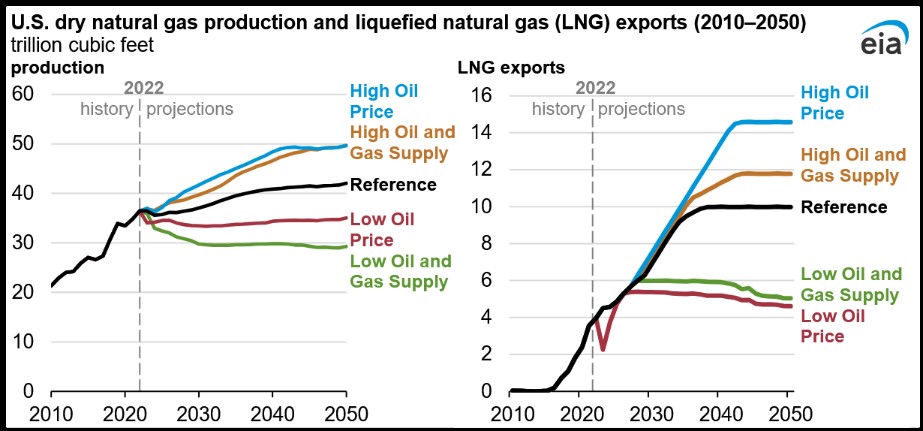

EIA’s Short-Term Energy Outlook projects Henry Hub averaging ~$4.01/MMBtu in 2026, with production rising to ~109.11 Bcf/d and LNG exports rising to ~16.3 Bcf/d.

That combination supports prices, but rising supply can help prevent runaway spikes (weather aside).

-

Power price direction is still heavily linked to natural gas

-

In many deregulated markets, gas often sets marginal power pricing so shopping electricity in 2026 should be treated like buying a gas-influenced commodity with seasonal risk premiums.

-

Capacity/reliability costs are now the “hidden landmine” (especially PJM)

-

PJM capacity auctions reset sharply higher: $269.92/MW-day (2025/26), $329.17/MW-day (2026/27 cap), and $333.44/MW-day (2027/28 cap).

This is a great reason to push businesses to act and to pick the right structure (fixed all-in vs energy-only vs block-and-index).

-

The best buying windows still exist but waiting is riskier

-

Shoulder-season buying logic still holds (avoid summer/winter risk premiums), but in 2026 the penalty for waiting grows because reliability/capacity is tighter. (This complements your 2025 “avoid peak increases later in the year” point.)

-

Suppliers compete hardest for clean, well-documented loads

-

This supports BidOnEnergy CTA: businesses that provide bills, interval data (if available), and clear start dates tend to unlock better pricing/terms (and faster approvals).

Why 2026 Is a Great Time to Lock In Commercial Electricity and Natural Gas Supply

In 2026, businesses have a high-leverage opportunity to control energy costs not just by finding a lower price, but by locking in the right supply structure before seasonal volatility and grid reliability costs hit harder. Natural gas fundamentals point to a steady-to-firmer price environment, while capacity and reliability charges are rising in key regions. Businesses that shop early, compare multiple terms, and secure budget certainty are positioned to win in 2026.

Section: What’s different in 2026

2026 is less about “prices falling” and more about “buying smart.”

Commodity markets may remain manageable, but non-commodity components especially capacity are repricing in some markets. That’s why it’s critical to compare fixed, fixed-with-pass-through, and structured products (like block-and-index) instead of assuming one contract type fits every business.

Section: 2026 data points to include (simple + credible)

-

EIA projects Henry Hub natural gas averaging ~$4.01/MMBtu in 2026, with U.S. dry gas production ~109 Bcf/d and LNG exports ~16.3 Bcf/d.

-

PJM capacity pricing has surged, clearing at or near the cap in recent auctions.

Section: “The risk of waiting” (modernized)

Waiting until peak summer or winter often forces buyers to accept higher risk premiums, fewer supplier options, and less flexibility. In 2026, the bigger danger is locking the wrong structure at the wrong time especially if your bill is exposed to capacity or index volatility.

CTA block

Compare commercial electricity and natural gas suppliers (free):

Upload your latest utility bill and we’ll return multiple supplier quotes across 12–60 month terms, including options for fixed, energy-only, and structured pricing.