PJM Capacity Auction 2025-2026

PJM Capacity Auction 2025-2026: What It Means for Electricity Rates

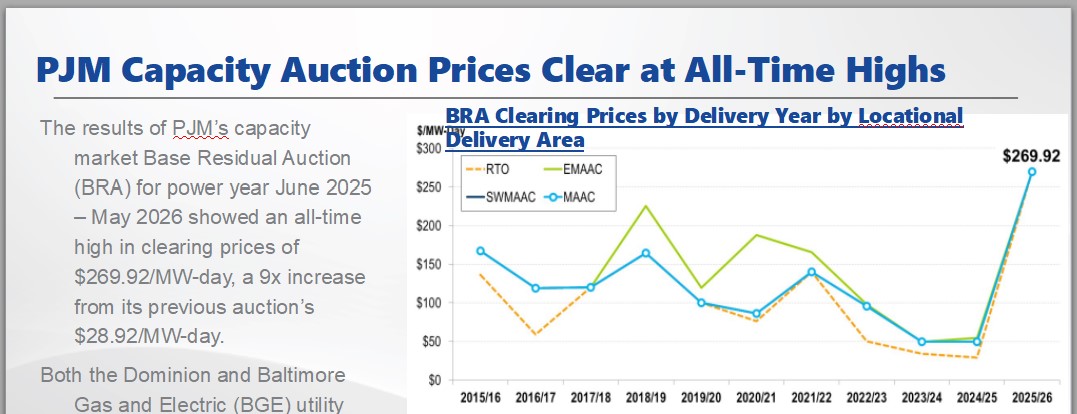

On July 30, 2024, PJM Interconnection, the Regional Transmission Organization managing the electric grid across 13 states, announced the results of its latest Base Residual Auction (BRA) for the 2025-2026 delivery year. This auction determines capacity prices, which power providers pay to ensure a reliable electricity supply. The results signal a massive price increase that will significantly impact electricity costs across PJM's service area.

Record-High Capacity Prices Set to Impact Bills

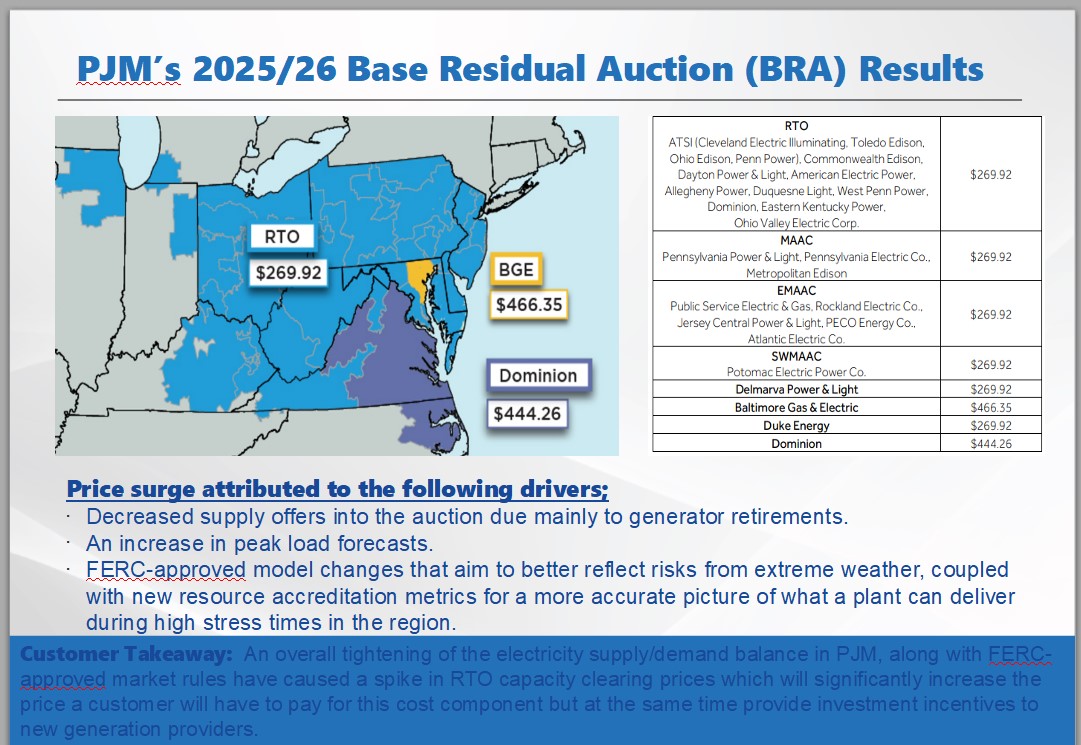

The PJM capacity auction for 2025-2026 produced unprecedented prices, with rates jumping from $28.92/MW-day in the previous auction to $269.92/MW-day. In some areas, like Baltimore Gas and Electric (BGE) in Maryland, prices soared even higher to $466.35/MW-day. This surge represents a dramatic 750% increase in costs, impacting both currently contracted accounts and those relying on local utility rates.

Exelon Anticipates Significant Rate Hikes

Exelon, a major utility serving 10.5 million customers across Delaware, Illinois, Maryland, New Jersey, Pennsylvania, and the District of Columbia, expects these auction results to drive customer bills up by more than 10%. The rate hikes will vary by utility, depending on local transmission capacity constraints and existing power supply contracts.

Challenges and Future Investments

Exelon President and CEO Calvin Butler noted the need for substantial infrastructure investments, especially in areas like Maryland’s BGE territory. The increased prices reflect a tightening supply-demand balance, highlighting the need for new generation and transmission infrastructure. Exelon plans to invest $34.5 billion in capital from 2024 to 2027, with an expected rate base growth of 7.5%.

Impact on the Broader Market

PJM's auction secured 135,684 MW for the 2025-2026 period, relying heavily on gas (48%), nuclear (21%), and coal (18%). However, concerns are growing about PJM’s reliance on fossil fuels and the limited integration of renewable energy sources. Critics argue that PJM’s capacity constraints and insufficient planning for diverse energy sources are driving these unprecedented price increases.

The Cost of PJM’s Capacity Auction

The total capacity bill for the region is projected to increase from $2.4 billion to approximately $14.7 billion. This significant rise could push retail power bills up by as much as 29%, starting mid-2025. Experts warn that this outcome reflects a failure to adapt to a cleaner energy future and the ongoing challenges in integrating renewable resources into the grid.

Key Drivers Behind the Price Surge

Several factors contributed to the record-high capacity prices, including:

- Decreased Supply: The retirement of older generators and a lack of new capacity have reduced available supply.

- Increased Demand: A rise in projected peak loads is straining the grid's capacity.

- Regulatory Changes: FERC-approved market reforms, including enhanced reliability modeling and stricter resource valuation, have tightened the market further.

Future Outlook: Will Change Come Soon Enough?

PJM is implementing reforms to address these issues, including processing about 72,000 MW of new resources in 2024 and 2025. However, progress remains slow due to external challenges such as financing, supply chain delays, and permitting hurdles. As PJM works to overcome these obstacles, consumers are left bearing the brunt of the current market dynamics.

The Need for Diverse Energy Sources

Experts emphasize the importance of diversifying PJM’s energy mix to include more renewable resources like wind and solar, which currently make up only 2% of the auctioned capacity. Without faster integration of these cleaner, more affordable options, the grid’s reliability and affordability are at risk.

This article highlights the critical issues facing PJM and the broader energy market as it grapples with balancing supply, demand, and the need for sustainable solutions. By understanding these challenges, businesses and consumers can better navigate the shifting landscape of electricity rates and grid reliability.