Energy Market Indicators Help Businesses Decide When to Buy Electricity and Natural Gas

Energy costs change every day. For many businesses, electricity and natural gas are major operating expenses, and timing plays a big role in whether a company pays a high rate or a competitive one. Energy market indicators make it possible for businesses to understand where the market is heading, why prices are moving, and when it may be the right moment to lock in a supply rate.

This article explains what energy market indicators are, why they matter, and how businesses use them to make smart purchasing decisions.

What Are Energy Market Indicators?

Energy market indicators are signals or data points that reveal trends in the electricity and natural-gas markets. They help businesses understand whether prices are likely to rise, fall, or remain stable.

The most common indicators include:

1. Natural Gas Storage Levels

Weekly U.S. storage reports show how much natural gas is available.

-

High storage = lower prices

-

Low storage = higher prices

Since natural gas drives electricity prices in most deregulated states, this single indicator often influences both markets.

2. Weather Forecasts

Weather is one of the most powerful price drivers.

-

Hot summers increase demand for electricity (AC).

-

Cold winters increase demand for natural gas (heating).

Weather models help businesses predict seasonal pricing.

3. Supply and Demand Balance

When demand is strong and supply is tight, prices tend to rise.

When demand falls or supply grows, prices drop.

Businesses watch these trends to determine price direction.

4. Futures Market Pricing

Energy futures on exchanges such as NYMEX give insight into what traders believe pricing will be months or years ahead.

If futures prices rise, it signals that traders expect supply to tighten.

5. Pipeline Capacity Constraints

When pipelines are congested or offline for maintenance, natural gas prices can spike—especially in the Northeast and Midwest.

6. Power Grid Conditions

Grid reliability, reserve margins, and capacity market signals affect electricity pricing.

Reports from regional grid operators (PJM, ISO-NE, ERCOT, NYISO, MISO) provide key market insight.

Why Energy Market Indicators Matter for Businesses

Businesses must choose when to secure their electricity or natural-gas supply contract. Buying at the wrong time—during a spike—can lock in high rates for years.

Indicators help businesses:

• Avoid buying during price spikes

Understanding what is driving the market keeps businesses from signing contracts during temporary surges.

• Lock in lower long-term costs

By tracking trends, companies can secure multi-year contracts when conditions are favorable.

• Build predictable budgets

Stable and lower supply rates help avoid unexpected cost increases.

• Reduce financial risk

Market indicators help companies avoid exposure to volatile price swings.

• Forecast future costs

Businesses can plan out 12–36 months by tracking market trends.

How Businesses Use Energy Market Indicators to Know When to Buy

Below are the most common strategies companies use.

1. Monitor Weekly and Monthly Market Reports

Energy brokers, consultants, and market analysts track indicators such as:

-

Henry Hub natural gas pricing

-

Forward strip prices

-

EIA storage reports

-

Weather models

-

ISO capacity and demand data

These reports help identify whether the market is trending up or down.

2. Watch for Seasonal Opportunities

The best times to buy energy are often:

-

Spring (March–May)

-

Fall (September–November)

Demand is usually lower, giving businesses access to softer pricing.

3. Buy When Volatility Drops

Low-volatility periods typically lead to better pricing and long-term stability.

4. Use Layered Purchasing

Some businesses buy part of their energy now and part later.

This reduces risk and averages the cost over time.

5. Long-Term vs. Short-Term Strategy

Indicators help companies decide:

-

Whether to lock in a fixed rate

-

Whether a hybrid product makes sense

-

When to extend an existing contract early (blend & extend)

Businesses use indicator trends to evaluate the right timing.

Electricity vs. Natural Gas Indicators: How They Differ

Although the two markets are connected, each has its own signals.

Electricity Indicators

-

Power grid demand

-

Renewable generation output

-

Capacity auctions

-

Transmission constraints

-

Day-ahead and real-time pricing

Natural Gas Indicators

-

Storage levels

-

Production rates

-

LNG exports

-

Pipeline congestion

-

Weather models

Understanding the difference helps businesses choose the best strategy for each commodity.

What Happens When Businesses Ignore Energy Market Indicators?

Companies that ignore market signals often fall into common mistakes:

-

Renewing too close to contract expiration

-

Buying during major weather events

-

Waiting until rates spike before taking action

-

Assuming energy prices only move once a year

These errors can cost thousands—or even hundreds of thousands over the life of a contract.

Businesses that follow indicators avoid these pitfalls.

How Energy Brokers and Consultants Use Market Indicators

Professional energy advisors constantly track:

-

Futures curves

-

Storage reports

-

Market volatility indexes

-

Regional grid reports

-

Weather patterns

-

Pricing from dozens of suppliers

They use this information to provide businesses with:

-

Timing recommendations

-

Risk-management strategies

-

Competitive bidding from multiple suppliers

-

Long-term purchasing plans

This ensures that businesses make decisions based on real-time data not guesswork.

Conclusion: Market Indicators Guide the Best Energy Purchasing Decisions

Energy market indicators give businesses the insight they need to decide when to buy electricity and natural gas, how long to lock in, and which strategy minimizes risk.

By watching trends such as:

-

Natural gas storage

-

Weather forecasts

-

Futures market prices

-

Supply and demand

-

Grid conditions

Businesses can avoid high prices, stabilize budgets, and secure long-term savings.

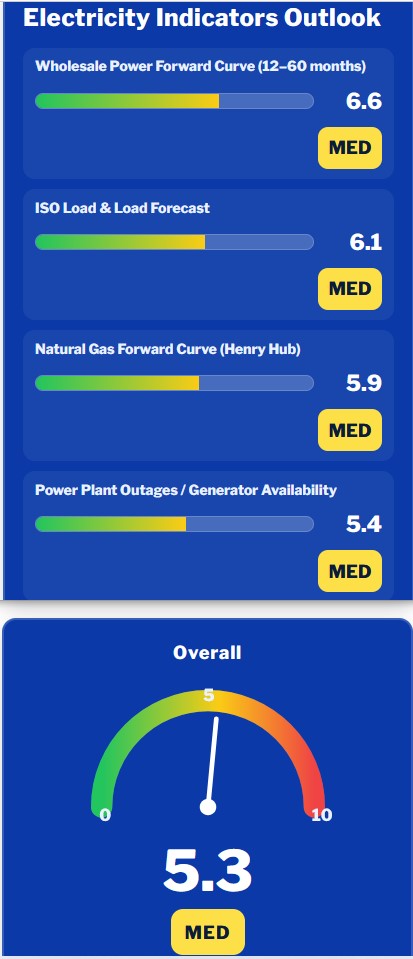

Electricity Market Indicators - Click Here

Natural Gas Market Indicators - Coming soon...