The best time to price an energy contract, Fall or Winter 2024-2025

The best time to price a contract for electricity or natural gas supply for Fall or Winter 2024-2025 typically depends on market trends, weather patterns, and broader energy market dynamics. Here are key factors and timing considerations:

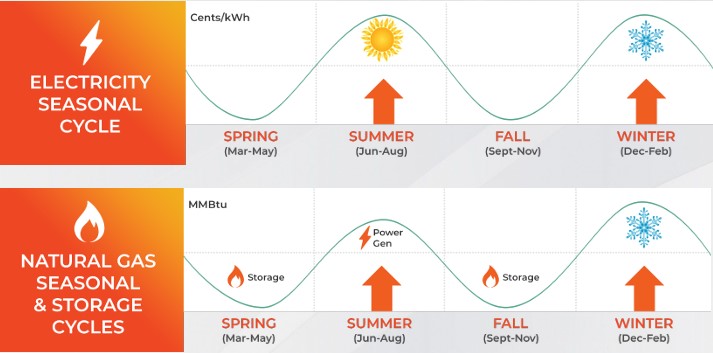

Shoulder Seasons (Spring and Fall)

Best Time: Historically, shoulder seasons (March-April and September-October) tend to offer lower prices. These are periods between high-demand seasons (summer and winter), during which energy prices are usually more stable and less volatile.

Why: During these times, demand for both electricity (for cooling in summer) and natural gas (for heating in winter) tends to be lower. Energy suppliers are often more willing to offer competitive pricing to lock in customers before demand spikes.

Avoid Peak Demand Periods (Summer and Winter)

Worst Time: Pricing contracts in the peak summer (June-August) or deep winter (December-February) can lead to higher rates due to elevated energy demand.

Why: In summer, air conditioning loads increase electricity demand, driving prices up. In winter, natural gas demand surges for heating, which can lead to price hikes, especially if cold snaps or polar vortexes occur.

Monitor Energy Market Trends

Best Time: If you notice a downward trend in energy prices due to oversupply, geopolitical stability, or favorable weather forecasts, it could be a good time to lock in a contract. Conversely, rising prices due to events like supply disruptions or extreme weather warnings could indicate it’s time to act quickly before rates increase.

Why: Energy prices fluctuate daily based on many factors, including fuel costs (e.g., natural gas prices affect electricity prices), supply chain issues, and government regulations. Tracking market trends helps identify when prices are relatively low.

Weather Forecasts

Best Time: Mild weather forecasts (mild winter predictions) can signal a good opportunity for lower natural gas and electricity rates. Fall (September-October) is a good period to lock in rates for winter, especially if there are predictions of milder winter conditions.

Why: Energy markets are sensitive to weather forecasts. A forecast for a mild winter can reduce expected heating demand, which can lead to lower natural gas prices. Locking in prices before any unanticipated weather extremes is critical.

Natural Gas Storage Levels

Best Time: High levels of natural gas in storage can suppress prices. If reports indicate storage is above the five-year average, it may signal a good time to secure a contract.

Why: High storage levels buffer against price spikes, especially during the winter. Monitoring storage reports from organizations like the U.S. Energy Information Administration (EIA) provides insights into future price movements.

Energy Market Policies and Regulations

Best Time: Keeping an eye on new energy policies or regulations that could affect energy prices is important. If policies are expected to impact future prices (like carbon taxes or renewable energy mandates), locking in rates before they take effect can be beneficial.

Why: Regulatory changes can drive long-term price changes. Understanding how such policies may affect supply and costs can help you lock in better rates before any price surges.

For Fall and Winter 2024-2025

The best time to price a contract is likely during the shoulder seasons (spring and early fall), particularly around September to October 2024. This period typically offers more stable, competitive pricing before the onset of high-demand winter months. Tracking market trends, natural gas storage levels, and weather forecasts can further help identify an ideal window for locking in energy contracts.